property tax in france for non residents

There is no lower threshold therefore you would be obliged to file a Déclaration des Revenus to report any rental income on an annual basis- returns are filed in AprilMay of the following year. Remuneration paid in return for work carried out on French soil is therefore taxable in France.

Buying A House In France As A Foreigner

It is possible to be considered a tax resident in two countries.

. France has signed tax treaties with more. сapital gains tax paid by the seller. In 2019 France implemented a taxation at source system and although this is not possible in practice for non-residents earning property rental income in France instead of a true taxation at source monthly stage payments are calculated and debited automatically from non-residents bank accounts French or SEPA based on the previous years taxation of the.

When a property changes hands in France the convention is that the buyer pays the main fee frais de notaire - more on that one shortly. There are a few differences for residents and non-residents but the bulk of the costs are the same for both. In the absence of treaty provisions French internal rules apply.

5 rows Non-resident individual. If one of you is a French resident for tax purposes and the other is not under the terms of a tax treaty and if you are married or in a civil partnership under a separation-of-property regime and you are living separately each of you must file an income tax return with the tax office with jurisdiction over your main residence for the resident and with the Individual Tax Department. Recent legislation in France has brought about significant changes to taxation for non-French tax residents who own or are looking to buy French residential property.

But there will likely be sellers fees too. However it is still possible for them to apply the full scale and to benefit from a lower tax rate. If you become resident in France you will only be taxed on your French assets for the first 5 years of residency.

Their corresponding amount reaches 58 of the purchase value of the property or taking into account the increase in the departmental tax. In order to avoid double taxation. Non-residents are liable on French real estate including rights over property situated in France.

For this the non-resident taxpayer must justify that a tax on his world income would lead to a lower rate. On 30 December 2017 the. How to file your income tax return in France.

Real estate assets whose net worth on January 1 is less than this amount is therefore not subject. People in France who are not tax residents are only taxed on income from French sources. Personal income tax rates for non-residents.

Who has to pay property tax in France. Non-residents need to consider relevant tax treaty to determine if France has the right to tax. On this basis and despite the Article 4B parameters it is possible for one of the spouses to a marriage to be tax resident in France whilst the other is non-resident.

Non-residents of France may also have a wealth tax liability but only on their French property assets. To this it would be necessary to add the expenses of notaries and other expenses these could increase the costs of acquisition to approximately 7 to 8 of the purchase price. The Wealth tax kicks in for French households whose combined worldwide assets are valued at more than 1 300 000 Euros on 1st January 2022.

Any assets located outside of France will be exempt from the ISF for 5 years. The French government have made it easier for non-residents to pay a lower rate of tax on French sourced income but there is no relenting on social charges. You will be taxed on your property income as a non-resident in France if you live in the country for less than 6 months throughout the year.

That obligation also arises on other French sourced investment. Profits tax if the acquired property is rented out. Capital gains tax in France Other than their main home French residents pay capital gains tax on worldwide property at 19 plus surtaxes plus social charges which are generally 172 but can be reduced to 75 for Form S1 holders.

Unless otherwise provided for by a tax treaty salaries paid to non-residents are subject to tax deducted at source. Non-residents for tax purposes. Residency for tax purposes is determined for each member of a household.

Non-residents pay the following taxes in France. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. As a non-resident owner of property in France you will be liable to pay income tax on your rental earnings.

Both taxes apply to non-residents as well as residents and are often higher on second homes than on main residences due to possible discounts on the main home. Non-residents declare your income. It should be noted that as an exception non-residents are subject to a minimum tax rate of 20.

If you are married or in a civil partnership and. As the guidance from the French government states. Non-residents who earn rental income from a property they own in France are liable in France to income tax on the net proceeds of that activity.

You need to have a look at the double taxation agreements between the two countries to determine where you should pay tax. Depending on the terms of the double taxation treaty between. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to 27519 and 30 for income above this threshold.

As a non-resident French leaseback property owner you are obliged to file a French business tax return and a French personal tax return. After you have been resident in France for 5 years if your global assets exceed 1300000 they will also be liable for taxation. Under the French leaseback scheme rental income incurs French VAT at a rate of 10 since 2014 tax year which means that a French VAT return also must be filed as VAT is charged on rents received.

Non tax residents in France are taxed only on their income from French sources we explain the taxation methods but also how to declare their income. If tax is due then the declaration needs to be filed around mid-May 2020 the exact deadline is not yet communicated by the tax authorities and it is the situation as at 1 January.

The 100th Issue Of Frenchentree Magazine Is On Sale Now Https Subscribeme To Frenchentree Things To Do France Languedoc

Property Rights And Property Taxes And Countries That Don T Have Them Property Tax Buying Property Property

Our Real Estate Services On The French Riviera And Paris Ile De France In 2022 Real Estate Services Us Real Estate French Riviera

Taxes In France A Complete Guide For Expats Expatica

Best Property Investment In Pakistan 2022 In 2022 Separating Rooms Ocean View Apartment Different Types Of Houses

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

French Personal Tax Rates Ashtons Legal Uk Solicitors

Valorvivienda Case In Vendita Immobiliare Notizie

Property Tax In Pakistan 2021 22 Ocean View Apartment Buying Property Property

Assessor Property Tax Data Scraping Services Property Tax Data Services Online Assessments

Taxe D Habitation French Residence Tax

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

French Property Buying Property In France Property

Window Tax One Of The Weirdest Taxes In History Jahrhundert Historisch 18 Jahrhundert

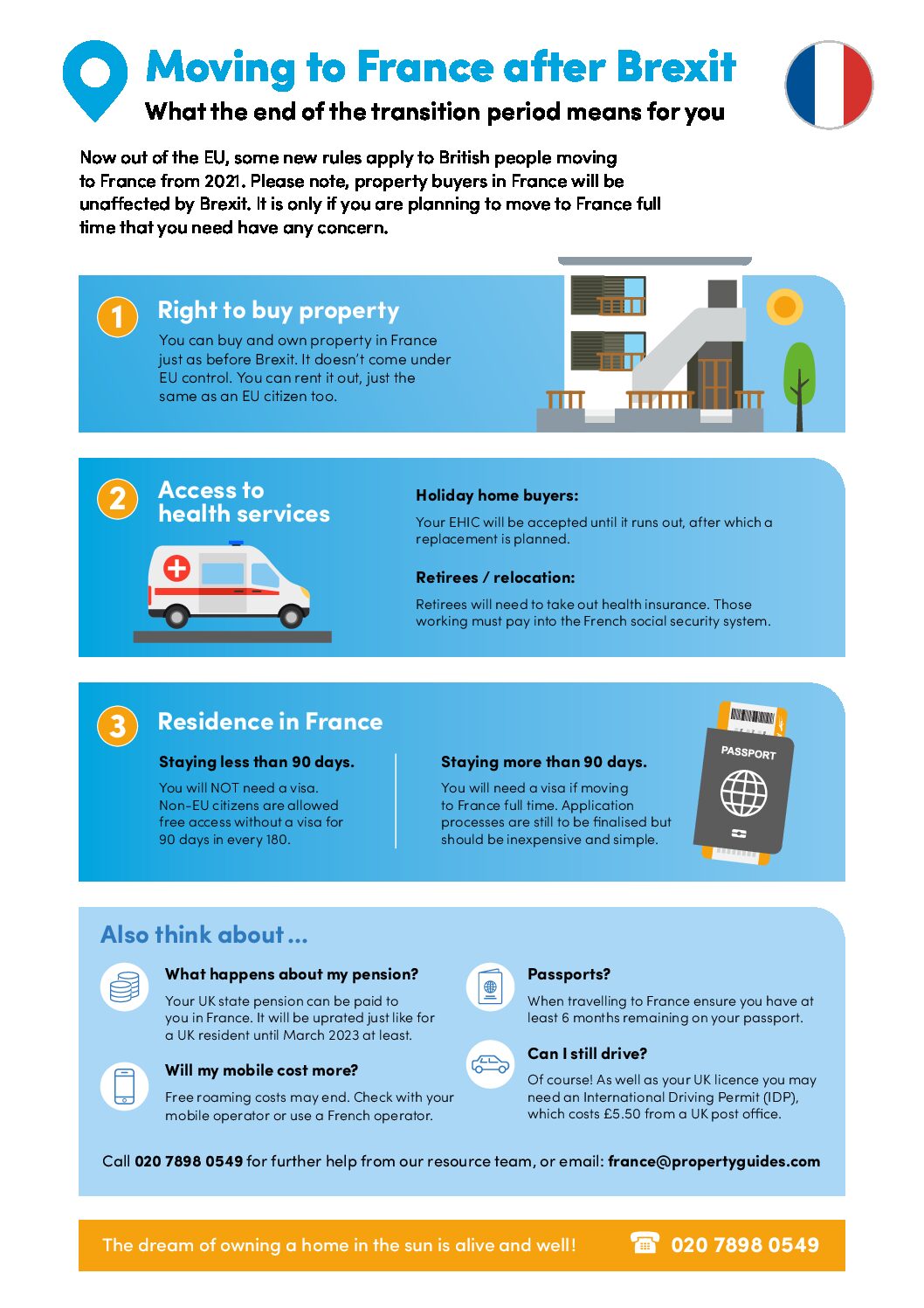

Buying Property In France After Brexit France Property Guides